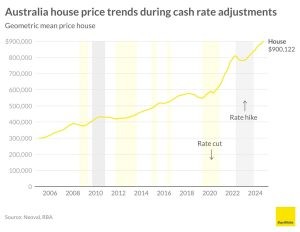

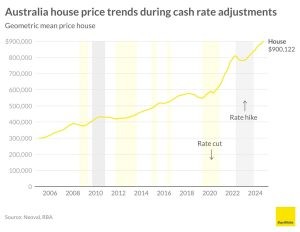

With a rate cut on the horizon, we are again at a turning point for Australia’s property market, making it timely to take another look at what drives price growth.

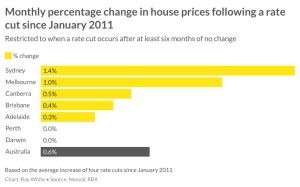

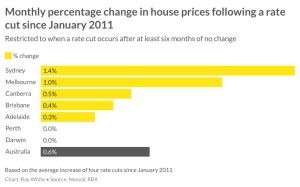

Right now, Melbourne and Sydney are slowing down rapidly, while south east Queensland and Perth continue their strong run. We looked recently at what happens in the month following an interest rate cut, however there are a lot of other drivers which can often make a bigger difference to price movements.

Interest rates

House prices are highly correlated with interest rates at a national level. Not surprisingly, as it becomes more expensive to pay off a loan, people can borrow less. Once you move beyond aggregates however, there are often other drivers that override this. Overall, Sydney and Melbourne are the most sensitive to interest rate changes primarily because of high debt levels. In more affordable locations, the link is a lot weaker. And in markets like Perth and Darwin, commodity cycles can have a much bigger impact.

The number of properties for sale

Simplistically, the more properties for sale suggests that price growth will moderate. However, markets can move in either direction depending on what is driving the growth in listings. For example, during the pandemic, we saw a big jump in properties for sale. Sellers were motivated by strong market conditions and we didn’t see a slow down in pricing until interest rates started to rise.

Conversely, a lot of properties are coming to market at the moment. Melbourne and Sydney are seeing price moderation as a result, however this is being driven by higher taxes and high interest rates. Interestingly, more properties are coming up for sale in Brisbane and Perth and a similar slowdown is not occuring.

Access to finance

Restrictions to finance slow down property markets, as can less competition between banks. At present restrictions to finance are fairly high, particularly the mortgage serviceability buffer at three percentage points. When being considered for a loan, buyers need to show that they can afford to pay a mortgage at a rate three per cent higher than the current rate. Competition between banks is also relatively low at the moment but is likely to become higher when rates are cut. More competition can lead to more loans being written and pressure on pricing.

Economic growth

In a strong growth economy, people are less worried about losing their jobs and when it comes to housing, their ability to pay off their loans. As a result, sentiment towards housing tends to be stronger. This was most sharply seen following the start of the pandemic. Although initially house prices declined, once it became apparent that the economic downturn would be short lived prices bounced back quickly.

Population growth

More people need more housing and population growth unsurprisingly results in house price rises. The evidence on this is most striking in small regional towns when there is some form of economic stimulus. The opening of a new mine for example can dramatically increase house prices, similarly very strong growth in tourism can have a similar effect. The impact of strong population growth has also been seen since the end of the pandemic when prices grew, despite interest rates rising rapidly.

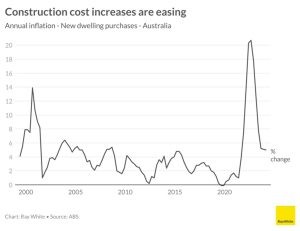

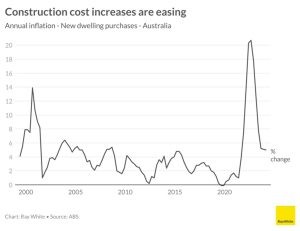

Construction costs

Sharp increases in construction costs have been a feature of the economy post pandemic, morphing from what started as supply chain blockages to the largest number of construction companies going into receivership ever recorded. Although it is now starting to be resolved, it remains a lot more expensive to build a new home now compared to pre-pandemic. This gap between the cost of building a new home and buying an existing one has been a driver of price growth over the past two years.

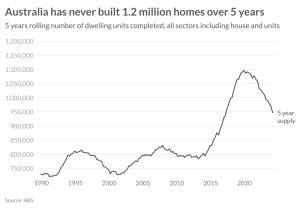

Housing supply

If population growth is occurring but housing supply is constrained, house price growth (and rental growth) will occur due to the shortage. Although this is the most direct way to ensure affordability, it is also the most complicated and difficult to achieve.

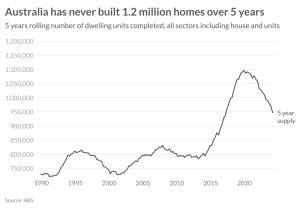

Right now, we are in an environment of constrained housing supply due to rising construction costs and this is likely to be a key factor in keeping house prices high despite a rising interest rate environment. However, the Federal Government is focused on housing supply, with an aim to build 1.2 million homes over five years, a target that is not on track and has never been achieved.

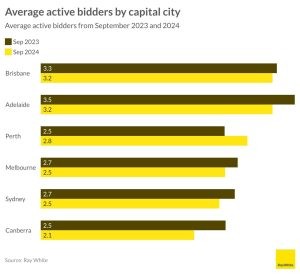

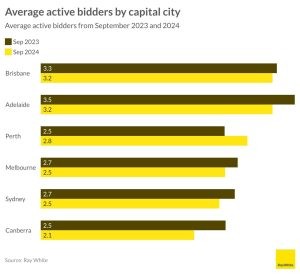

Sentiment towards property

Although interest rate increases can explain the most recent slowdown in house prices, sentiment towards housing is also a factor. Last year, it was a seller’s market – prices were moving quickly and the number of people bidding at auction hit record highs. Since the start of the year, the market has shifted in most locations, with the number of bidders per home at auction reducing. This has led to price growth softening.

Taxation

Taxation can be used as both a deterrent to buying, as well as an incentive. Generally it’s used to drive certain behaviour – for example, negative gearing ensures we have enough rental housing while stamp duty reductions are used to encourage first home buyers. While it does achieve certain goals, it can often drive up (or down) prices.

The impact of cutting tax incentives available to investors was most recently seen in New Zealand. The government cut tax deductibility of interest payments to investors in 2021. As a result investment in housing halved with investor lending plummeting from $21 billion in 2021 to just $11.8 billion in 2024. New Zealand is now the least affordable rental market in the world and the policy has now been reversed. House prices dropped over the same time, coinciding with very sharp increases in interest rates and low levels of population growth.

Urban regeneration

Urban regeneration can result in significant price increases over a prolonged time period. Within large cities, this generally happens when older people move out of a suburb and young people move in their place. It can also be driven by more subtle drivers such as a renewed retail precinct or traffic calming within a neighbourhood. Price growth driven by urban regeneration occurs over a prolonged period.

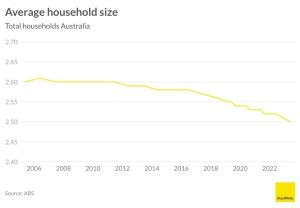

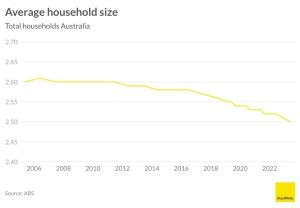

Demographic change

Changing preferences for housing and demographic change can lead to prices rising. Average household size has been declining long term but at the same time, Australian housing is predominantly three bedrooms or more. This has resulted in a low number of people per home and a lot of spare bedrooms. Low levels of housing efficiency also drive price growth long term.

Infrastructure improvements

Significant infrastructure spending can completely change house values in the areas that they benefit. The announcement of the Western Sydney airport and the subsequent investment that has taken place since then has led to marked changes to housing demand in the surrounding area. Similarly, continued investment in transport links between Geelong and Melbourne have led to pricing in Geelong more closely resembling Melbourne pricing.

However, not all infrastructure is equal in driving price growth. For example, a new major freeway may reduce price growth for places located adjacent to the new road. In comparison, homes a little bit further away would benefit from better connectivity and may see price increases as a result.

Government policy

Government policy can change house prices. Easing up of planning controls can lower the cost of housing while policies that put more money in people’s hands can increase them. First home buyer incentives are particularly successful in getting more first home buyers into the market but as a Productivity Commission report has shown, also drives up prices at cheaper price points.

Performance of other investment types

Property is a popular way to create wealth in Australia, however it is not the only way. Other investment types such as bitcoin, shares and savings accounts are also popular. In many ways, owning property is more labour intensive than shares (e.g., maintaining the property, ensuring it is rented out etc) and some people prefer a more hands off approach, particularly if alternative investments offer better returns.